Why German equities are currently outperforming French equities

Three surprises are currently shaping the European equity markets: 1) the rise of the DAX so far this year, 2) which stocks and sectors have driven the upturn on the German stock market to date, and 3) the significant performance gap between the German and French stock markets.

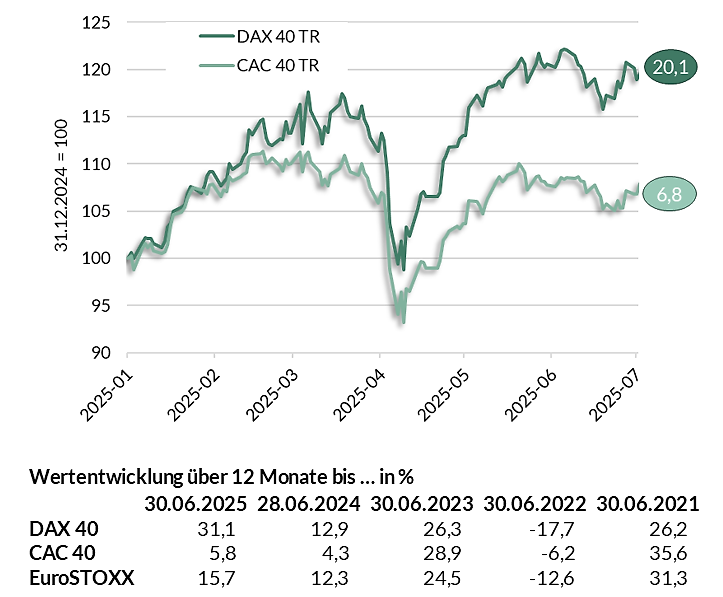

In the first half of 2025, the DAX rose by around 20 per cent, while the CAC40, including dividend payments, gained just under 7 per cent (see Fig. 1). Judging by the news, there are not many reasons why German equities should be performing particularly well at present: the key sector of the German economy, automotive manufacturing, is under pressure from all sides. The US is protecting itself with import tariffs. At the same time, Chinese exporters are trying to gain market share worldwide – not least in Europe – in the promising electric mobility business. Economic growth in Germany is struggling to stay above zero.

Fig. 1: Performance of the DAX 40 and CAC 40 in the first half of 2025 (total return)

Source: LSEG Datastream; TR: Total Return (performance)

The CAC 40 is similar to the DAX in many respects. According to Bloomberg, the DAX currently represents a market capitalisation of almost €2.2 trillion, while the CAC represents just under €2.5 trillion. For most companies in the DAX and CAC 40, Europe is the most important sales market. However, America and Asia also play a major, and in some cases very significant, role for many of them. Companies in both countries face similar challenges: sluggish productivity and economic growth in their home markets and economic uncertainty due to US trade policy. Another similarity is the ECB’s monetary policy, which provided further relief on the interest rate front in the first half of the year.

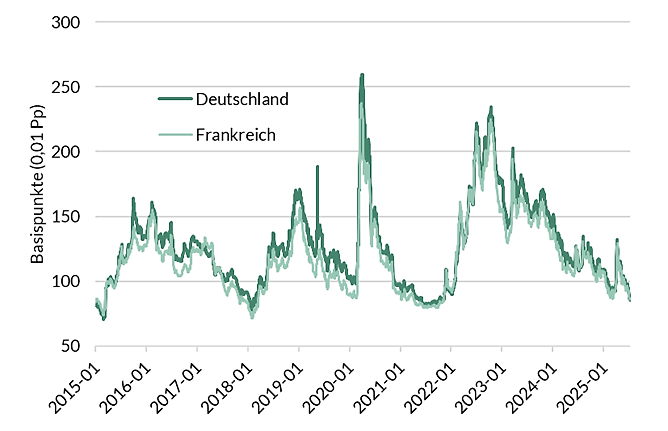

In addition, financing conditions on the bond market are similar for issuers in both countries. A comparison of the yields on French and German corporate bonds (measured by the French and German versions of the Bloomberg Euro Aggregate Corporate Index) reveals only minor differences in yields and spreads. Credit quality, liquidity and maturities determine the level of financing costs for European companies on the bond market, while ‘nationality’ (the company’s registered office) does not currently play a significant role.

Fig. 2: Credit risk premiums on the market for German and French corporate bonds

Source: Bloomberg, Bloomberg Euro Aggregate Corporate Total Return Germany and France Unhedged Euro; option-adjusted spreads against German government bonds, in basis points (1 basis point = 0.01 percentage point)

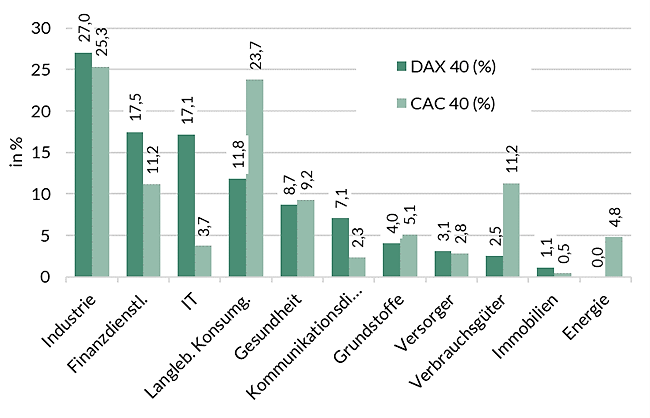

As in Germany, the positive momentum for the French stock market in the first half of the year came primarily from the industrial sector, financial services providers and the IT sector. The industrial sector has the highest weighting in both indices, at more than 25 per cent each (see Fig. 3). Financial policy is likely to be a decisive advantage for German companies. After the federal elections at the end of February and even before the coalition negotiations were concluded, the black-red coalition partners launched two extensive projects: a €500 billion infrastructure package and the creation of financial leeway for a significant expansion of defence spending. On the French side, however, the difficult budgetary situation and the majority situation in the French National Assembly, which is problematic from a corporate perspective, are weighing on the economy. As a result, the contribution of the industrial sector to performance on the German side was almost 10 per cent, around twice as high as on the French side.

Fig. 3: Comparison of the sectoral structure of the DAX 40 and CAC 40 (in % of current market capitalisation, as at 8 July 2025)

Source: Bloomberg, ODDO BHF SE; figures based on the cumulative market capitalisation of the index members

Financial services providers showed signs of strength in both countries. The banking sector, where the steeper yield curve is creating a more comfortable interest rate environment, performed particularly well thanks to robust business figures, solid balance sheets and manageable credit risks. With regard to Commerzbank, the takeover efforts by the major Italian bank Unicredit are also likely to have played a role. Overall, the high weighting of banks within the French financial sector is likely to have contributed to the fact that the performance differences between the financial sectors of the DAX and CAC 40 are not significant.

The IT sector, with SAP and semiconductor manufacturer Infineon as its heavyweights, was definitely a plus for the DAX. The consumer goods sector, especially durable consumer goods, contributed significantly to the relative misery of the CAC 40. These account for almost 24 per cent of the CAC 40’s market capitalisation. In the DAX, their share is a modest 12 per cent. Overall, the consumer sector in the DAX accounts for less than half of the weighting in the CAC 40.

The DAX made a strong spurt in the first half of 2025, while the CAC 40 struggled to get off the ground. The reasons for the significant performance differences can be explained in part by German fiscal policy. The DAX has a reputation for reacting sensitively to changes in economic expectations and is benefiting from the announced shift in German fiscal policy – from an overly restrictive to a very expansionary spending policy.

The German market is already looking pretty expensive. According to Bloomberg, the price-earnings ratio (P/E based on expected earnings for the next 12 months) for the DAX is 15.9, well above the 10-year average of 13.1. The P/E ratio for the CAC 40 is currently 14.8, which is closer to the long-term average (13.8). In our view, this suggests that investors should focus more on actual and prospective earnings growth. The reporting period for the second quarter is beginning. We are maintaining our high weighting in European equities.

Disclaimer

This document has been prepared by ODDO BHF for information purposes only. It does not create any obligations on the part of ODDO BHF. The opinions expressed in this document correspond to the market expectations of ODDO BHF at the time of publication. They may change according to market conditions and ODDO BHF cannot be held contractually responsible for them. Any references to single stocks have been included for illustrative purposes only. Before investing in any asset class, it is strongly recommended that potential investors make detailed enquiries about the risks to which these asset classes are exposed, in particular the risk of capital loss.

ODDO BHF

12, boulevard de la Madeleine – 75440 Paris Cedex 09 France – Phone: 33(0)1 44 51 85 00 – Fax: 33(0)1 44 51 85 10 –www.oddo-bhf.com ODDO BHF SCA, a limited partnership limited by shares with a capital of €73,193,472- – RCS 652 027 384 Paris –

Approved as a credit institution by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and registered with ORIAS as an insurance broker under number 08046444. – www.oddo-bhf.com