Some unexpected effects of Trump’s policies

KEY POINTS:

- During his inauguration, Donald Trump promised a new golden age of economic prosperity

- After a few months in office, investor sentiment is quite different

- The ‘America First’ strategy is proving unfavourable for the dollar

- The United States’ geopolitical non-interventionism is fuelling conflicts

- Erratic tariff policy only creates losers

Trade wars are easy to win. I will end all wars within 24 hours. A new golden age has begun for America. Tariffs will be enough to eliminate income tax, etc. These are just some of the bold statements that the US president is known for making. What is the reality? Every day brings new evidence that the main thrust of Donald Trump’s economic policy is not having the desired effect, and often even has the opposite effect to what was proclaimed with such emphasis.

Trade wars are hard to win – When it comes to international trade, Donald Trump is very consistent. He sees trade as a zero-sum game in which the losers are those with deficits and the winners are those with surpluses. As the United States runs a deficit with almost every country in the world, this situation is obviously intolerable to him, and he intends to correct it by imposing customs barriers. During his first term, in 2018 and 2019, he waged a tariff war against China, which ended after two years in a kind of stalemate, with each side imposing higher tariffs on the other’s products. It was a draw. This time, the tariff war is broader in scope, as it affects all countries, and more intense, as the tariff increases are unprecedented in decades.

What has the United States gained in this affair? The amount of customs revenue collected by the US Treasury has certainly increased significantly in recent months. It rose from around $8 billion in January to nearly $25 billion in May. But these taxes are paid by US importers, not by the rest of the world, as Donald Trump claims. In other words, it is a tax imposed on the US economy with the ultimate aim of reducing access to foreign products and encouraging local production. However, consumers must still be offered an affordable substitute. This is rarely the case. In a world characterised by strong interdependence between countries, trade wars are not a zero-sum game but a negative-sum game, with only losers.

US non-interventionism fuels conflict – In addition to their dramatic human and material consequences, wars tend to increase production costs. This is particularly true when the countries involved are major suppliers of raw materials (Russian gas, Middle Eastern oil). Conflicts also increase uncertainty, which is detrimental to business investment decisions. Periods of peace are more conducive to economic prosperity than periods of war. In this sense, any effort to end conflicts is welcome.

From this perspective, as the world’s leading military power, the United States has a decisive influence in encouraging the resolution of geopolitical tensions. In keeping with a certain tradition in American history, Donald Trump is more in favour of disengagement. This may have the opposite effect to that desired. In the war between Russia and Ukraine, sending the two belligerents back to square one as if the blame were equally shared will prolong the hostilities. In the Middle East, the United States’ procrastination on the Iranian issue over the years is partly responsible for the sudden escalation of tensions. As this is happening in one of the main oil-producing and transit regions, the risk of a new oil shock cannot, unfortunately, be ruled out.

America First is negative for the dollar and US debt – In the three months between Donald Trump’s victory and his inauguration, a sense of euphoria had set in. The US economy had shown strength in 2023 and 2024, absorbing the shock of monetary tightening without damage. The outlook was bright, given the promises of tax cuts and deregulation. The potentially destabilising aspects of the programme, such as the trade war, growing budget deficits, the mass expulsion of illegal immigrants and attacks on the independence of the central bank, were relegated to the background.

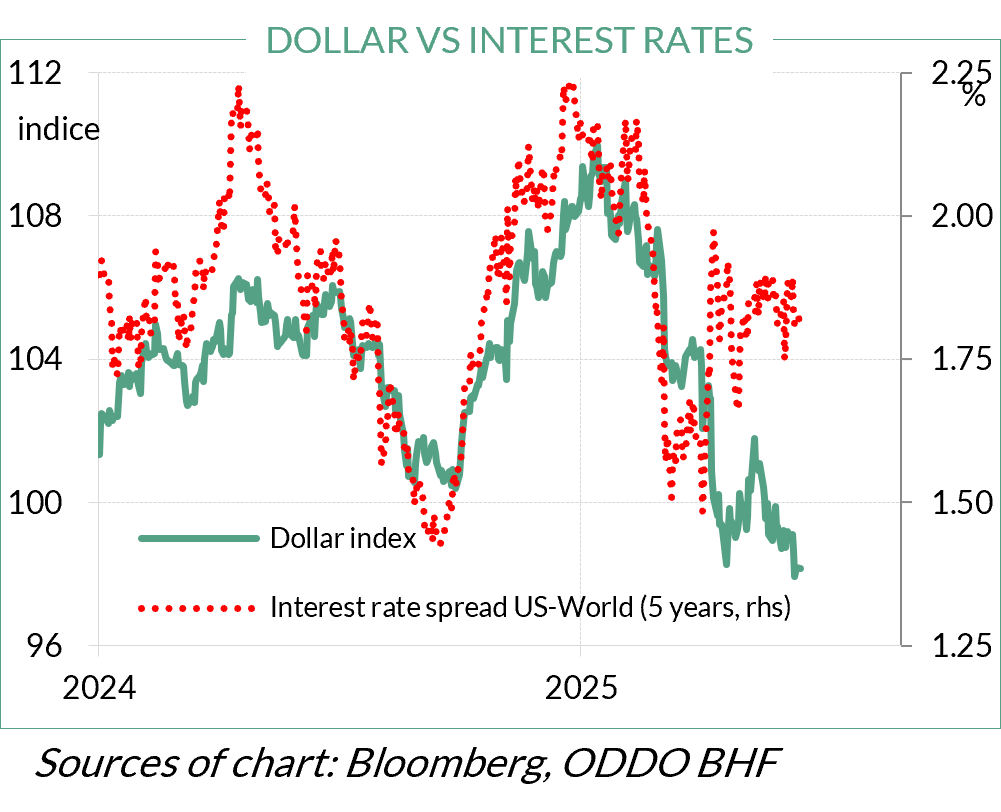

The erratic nature of tariff policy and the difficulty in finalising the tax cut programme due to divisions within the Republican Party have led investors to reassess their assessment of US risk. Or should we rather talk about Trump risk? The excess returns offered by US rates should logically support the dollar. In fact, since Donald Trump took office, the dollar has fallen by more than 10% against a basket of other major currencies (see chart). Although a weak dollar is not unwelcome to the US president, the circumstances surrounding this decline are worrying because they reflect doubts about the quality of certain US financial assets, particularly public debt.

On several occasions, faced with the adverse effects of his policies, the US president has had to backtrack, earning himself the nickname TACO (Trump Always Chickens Out). For example, when major retail chains argued that 145% tariffs on China could lead to shortages for Americans. Or when car manufacturers told him they were dependent on China for some of the inputs for their production processes. Or when the agriculture and hotel industry lobbies showed him that they could not do without foreign labour in the United States. Or when investors expressed their fears that he would dismiss the chairman of the Federal Reserve.

When a policy is bad, a reversal is welcome, of course, but constant U-turns show that policies designed for the television cameras without careful consideration of their consequences are dangerous. By zigzagging along the edge of the precipice, we could well end up going off the road one day.

Disclaimer

This document has been prepared by ODDO BHF for information purposes only. It does not create any obligations on the part of ODDO BHF. The opinions expressed in this document correspond to the market expectations of ODDO BHF at the time of publication. They may change according to market conditions and ODDO BHF cannot be held contractually responsible for them. Any references to single stocks have been included for illustrative purposes only. Before investing in any asset class, it is strongly recommended that potential investors make detailed enquiries about the risks to which these asset classes are exposed, in particular the risk of capital loss.

ODDO BHF

12, boulevard de la Madeleine – 75440 Paris Cedex 09 France – Phone: 33(0)1 44 51 85 00 – Fax: 33(0)1 44 51 85 10 –

www.oddo-bhf.com ODDO BHF SCA, a limited partnership limited by shares with a capital of €73,193,472 – RCS 652 027 384 Paris –

approved as a credit institution by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and registered with ORIAS as an

insurance broker under number 08046444. – www.oddo-bhf.com