Geopolitical crises also create buying opportunities on the markets

The Israeli air strikes on targets in Iran on the night of Friday, 13 June 2025 took the world completely by surprise. Crude oil prices jumped sharply on the markets the following day. On Friday, the price climbed by almost $9 to $78.50 per barrel at its peak. But although both countries continued to launch drone and missile attacks in the days that followed, the oil price fell back further on Monday. Prices are currently around $72 per barrel. The initial reaction on the stock markets was also subdued: the S&P 500’s drop of just over 1 per cent on Friday was followed by a rapid rise on Monday, restoring the status quo before the fighting began.

This does not have to remain the case. No one can reliably predict how the Middle East conflict will develop. The only certainty is that the conflict in this region of the world has now reached a new level of escalation and, alongside the war against Ukraine, which Russia’s leader Vladimir Putin has so far shown no intention of ending, is creating further uncertainty around the world. Investors cannot ignore the new situation either. The number of geopolitical flashpoints has increased once again.

From today’s perspective, the greatest threat emanating from the Middle East is that Iran could close the Strait of Hormuz – the bottleneck of the global oil economy. However, Tehran has never dared to do so, probably because it would also affect the neighbouring countries in the Persian Gulf – Iraq, Kuwait, Qatar, the United Arab Emirates and, to a lesser extent, Saudi Arabia. The world’s dependence on oil from the Middle East has also steadily declined in recent years. The development of new energy sources has contributed to this, as has the exploitation of large oil fields outside the region, for example in the United States, Canada and along the African coast. On the Monday after the start of the Israeli air offensive, the OPEC oil cartel presented its June monthly report. In it, the organisation assumes that supply in the second half of 2025 will not decrease significantly compared to the first half. According to OPEC, supply growth will come from the US, Brazil, Canada and Argentina.

The financial markets are not immune to such geopolitical shocks. Higher volatility is usually the result. In most cases, the increased price fluctuations originate in the commodity and foreign exchange markets, but then also spread to the stock and bond markets. Many investors try to reduce the risk in their portfolios and move their investments to supposedly safe havens. These are usually gold, government bonds with high credit ratings, the Swiss franc and, most recently, the US dollar. A change in risk perception often leads to a reduction in positions in emerging markets.

Given the new uncertainty about how the conflicts in the Middle East will unfold, investors will have to brace themselves for increased market volatility in the foreseeable future. We currently see this as the main risk of this new escalation: high volatility on the bond and equity markets, reflecting investor uncertainty.

Even though energy prices have fallen again from the crisis levels of around two years ago, the situation on the energy markets remains tense due to a possible tightening of sanctions against Russia. An escalation of the conflicts in the Middle East would cause turmoil, particularly on the oil and natural gas markets. It should be borne in mind that the global economy is already under stress due to trade tensions. If, contrary to OPEC forecasts, energy supplies were to tighten, this would hit the global economy at a difficult time and in a still vulnerable area. Transport costs would rise, existing supply chains would be disrupted and some exposed sectors could be hit hard. Many developing and emerging countries would also likely be vulnerable to an energy crisis.

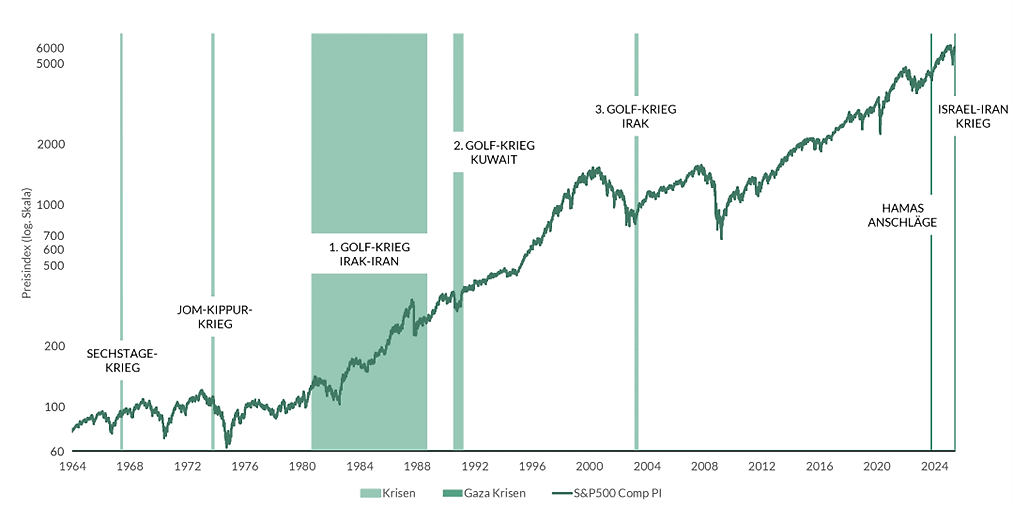

It cannot be ruled out that certain asset classes, regions or sectors will suffer from the heightened geopolitical situation. However, history shows that stock prices have risen again in the long term after such military conflicts in the past. The numerous armed conflicts that have ravaged the Middle East over the past decades have not interrupted the upward trend on the markets in the long term, as the figure below shows. Regional conflicts – as long as they remain regional – have so far had little impact on international stock markets.

Figure: Performance of the S&P 500 and conflicts in the Middle East

Source: Datastream, S&P 500 price index; additional selected crises, period: 31 December 1963 – 16 June 2025.

Long-term investors should therefore take a cool-headed look at their portfolios and refrain from rushing to sell positions. Nevertheless, we are currently taking a somewhat more cautious stance in view of the renewed rise in valuations and continued elevated economic risks. We are convinced that now is not the time to take on equity risk. At the same time, we are scanning the market for stocks that we consider interesting. Should market turmoil increase again and valuations fall, we would consider entering or increasing our positions. Buying opportunities will arise again for long-term investors.

Disclaimer

This document has been prepared by ODDO BHF for information purposes only. It does not create any obligations on the part of ODDO BHF. The opinions expressed in this document correspond to the market expectations of ODDO BHF at the time of publication. They may change according to market conditions and ODDO BHF cannot be held contractually responsible for them. Any references to single stocks have been included for illustrative purposes only. Before investing in any asset class, it is strongly recommended that potential investors make detailed enquiries about the risks to which these asset classes are exposed, in particular the risk of capital loss.

ODDO BHF

12, boulevard de la Madeleine – 75440 Paris Cedex 09 France – Phone: 33(0)1 44 51 85 00 – Fax: 33(0)1 44 51 85 10 –www.oddo-bhf.com ODDO BHF SCA, a limited partnership limited by shares with a capital of €73,193,472- – RCS 652 027 384 Paris –

Approved as a credit institution by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and registered with ORIAS as an insurance broker under number 08046444. – www.oddo-bhf.com