What is the outlook for interest rates?

- In 2026, the baseline scenario points to a fairly robust global economy with no inflationary pressures.

- Markets expect the Fed to continue lowering its policy rates.

- However, several factors could put upward pressure on prices and interest rates

- Protectionism is gaining momentum, increasing the cost of global trade.

- Expansionary fiscal policies (in the U.S., Germany, and Japan) are set to widen deficits.

For major international organizations such as the IMF and the OECD, the economic outlook for 2026 is almost a carbon copy of last year’s. With Donald Trump now leading the United States and facing midterm elections in a few months, episodes of uncertainty and volatility are inevitable — but no major rupture is expected. At the global level, economic growth is projected to remain on a trajectory slightly above 3%, in line with recent years.

Across major regions, this baseline scenario can be outlined as follows. The U.S. economy is expected to remain supported by strong household spending and the ongoing boom in artificial intelligence. In China, by contrast, consumer sentiment remains subdued, but the country’s industrial engine continues to push forward relentlessly. Europe finds itself caught in a vise — pressured by higher U.S. tariffs on one side and intensifying Chinese competition on the other. Yet thanks to a few internal stabilizers — a resilient labor market and a recovery in bank lending — it should, as in 2025, manage to keep its head above water. In this environment, inflation would continue to normalize globally, especially in the United States. The Fed would therefore see no barrier to extending its rate‑cut cycle and expanding liquidity creation, thereby also exerting downward pressure on long‑term yields. Under such conditions, current elevated asset prices would appear justified. Everything would continue to run smoothly.

But let’s consider a different scenario. What if inflation, instead of continuing to decline, started to rise again? Households would see this as a new shock to their purchasing power, weakening their ability to spend. Central banks would be forced to adopt a more restrictive (or at least less accommodative) monetary stance—otherwise they would risk further damaging their anti‑inflation credibility, already undermined by their misjudgment in 2021. Such a scenario would catch most market observers off guard.

Is the hypothesis of an inflation resurgence far‑fetched? Even if it is not the baseline scenario, several risk factors need to be considered — especially in the United States, which ultimately remains the key market setting the tone for major global financial trends.

Over the past year, the average tariff rate on goods imported into the United States has increased fivefold, rising from 2.5% to around 12%. Evidence shows that exporters in the rest of the world have not significantly lowered their selling prices in response — contrary to President Trump’s claims. It is the U.S. importers who are absorbing the cost of these tariffs. So far, they have managed the shock by drawing down inventories accumulated before the tariff hikes and by taking a substantial portion of the hit into their margins, which has kept the impact on final consumers relatively moderate. However, the effect of these tariff increases may intensify in the coming months, preventing inflation from continuing to decline.

During the post‑Covid recovery, global supply chains were under severe strain. This led to delivery delays, shortages, and ultimately rising prices. The current situation is not comparable, but the rise in protectionism around the world is adding friction to global trade. Once again, this could fuel higher prices for intermediate goods — and potentially contribute to renewed inflationary pressures.

Another source of risk is the expansionary direction of fiscal policies in many countries. The fiscal impulse is roughly one percentage point of GDP in the United States (tax cuts), in Japan (stimulus measures introduced by the new government), and in Germany (infrastructure and defense spending plans). In China, the government has extended several consumption‑support mechanisms. If we assume that the global economy is currently operating close to its potential, then additional fiscal stimulus could generate short‑term overheating and inflationary consequences.

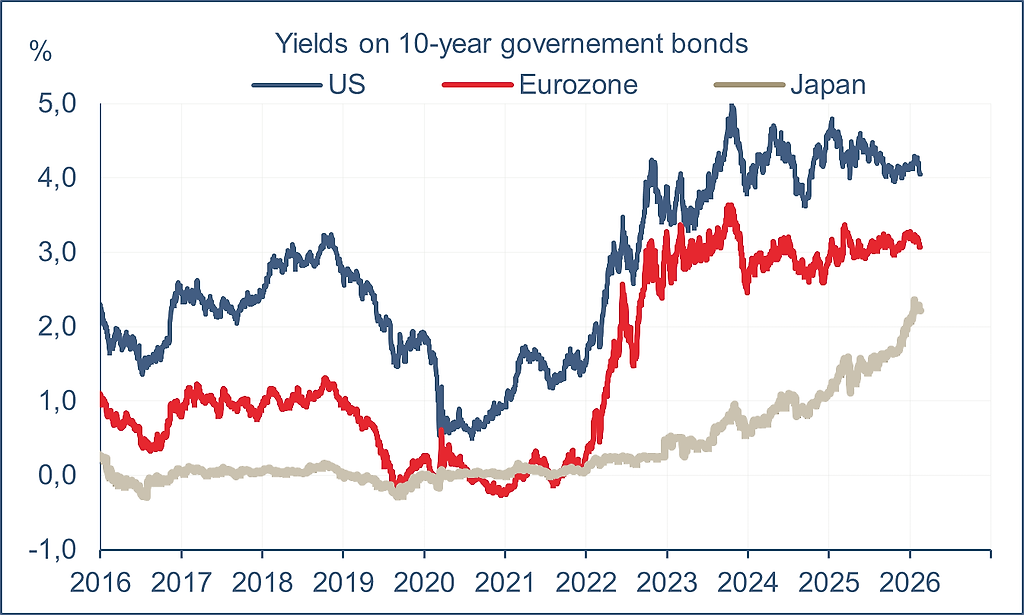

Inflation is heavily influenced by household psychology and, by extension, by the confidence people have in central banks’ ability to preserve the value of money — and therefore their purchasing power. This confidence was shaken during the inflation shock of 2022–2023. Donald Trump’s repeated attacks on the Fed, his intention to bring it under tighter political control by appointing loyalists to key positions, and his stated preference for a weaker dollar could all prompt investors to demand a higher risk premium, pushing interest rates upward. The upward trend has already been in place for several years (see chart). Given the fragility of public finances in many countries, it would not take much to amplify this movement.

Source : Bloomberg, ODDO BHF

Past performance is not a reliable indicator of future returns and is subject to fluctuation over time. Performance may rise or fall for investments with foreign currency exposure due to exchange rate fluctuations. Emerging markets may be subject to more political, economic or structural challenges than developed markets, which may result in a higher risk

Disclaimer

This document has been prepared by ODDO BHF for information purposes only. It does not create any obligations on the part of ODDO BHF. The opinions expressed in this document correspond to the market expectations of ODDO BHF at the time of publication. They may change according to market conditions and ODDO BHF cannot be held contractually responsible for them. Any references to single stocks have been included for illustrative purposes only. Before investing in any asset class, it is strongly recommended that potential investors make detailed enquiries about the risks to which these asset classes are exposed, in particular the risk of capital loss.

ODDO BHF

12, boulevard de la Madeleine – 75440 Paris Cedex 09 France – Phone: 33(0)1 44 51 85 00 – Fax: 33(0)1 44 51 85 10 –

www.oddo-bhf.com ODDO BHF SCA, a limited partnership limited by shares with a capital of €73,193,472 – RCS 652 027 384 Paris – approved as a credit institution by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and registered with ORIAS as an insurance broker under number 08046444. – www.oddo-bhf.com