Three key messages on the global financial situation: debt, growth, and AI dynamics

While industrialized countries are increasingly facing economic policy challenges, the stock markets seem to be only marginally interested in Germany’s weak growth or the debt crisis in the US and France. This is because another factor is driving the stock market: artificial intelligence and the prospect of falling interest rates.

Challenges facing industrialized countries: debt crisis versus growth crisis

After years of crisis policy and zero interest rates, economies are facing different challenges. While Germany is experiencing structural weak growth due to weak public and private investment, bureaucratic hurdles, a shortage of skilled workers, high energy costs, and low productivity gains, the US is growing steadily—as is its debt level.

Since 2002, the US federal budget has been permanently living beyond its means. Budget deficits of ten to fifteen percent shortly after the financial crisis and in the wake of the coronavirus pandemic caused the debt ratio to rise, as in many other countries. But even in years of strong growth, the US federal budget stimulated the economy with debt financing. The result: a debt level of more than 120 percent of GDP and interest costs that exceed the defense budget.

To counter the danger of spiraling debt, the European Union established debt rules in the 1997 Treaty of Amsterdam. However, more than half of the EU member states violated the rules of the “Stability and Growth Pact” last year, which stipulate a maximum deficit ratio of 3 percent and a debt ratio of 60 percent measured against GDP. Deficit procedures against countries such as France and Italy are currently underway. Nevertheless, the French government has accumulated 3.3 trillion euros in debt, which is more than 110 percent of GDP. However, debt reduction is currently out of the question, as the annual budget deficit is more than 5 percent per year. The last budget surplus was 45 years ago – France last generated a budget surplus in 1980. Since then, the French government has been living beyond its means and spending more money on social welfare (relative to GDP) than any other country in the world.

France, Germany, and the US will therefore face different economic challenges in the coming years. Both France and the US are struggling with high public debt ratios and primary deficits that are no longer in line with future growth. Both countries will have to exercise greater budgetary discipline in the coming years, or they risk only being able to borrow at an ever-increasing risk premium in the future.

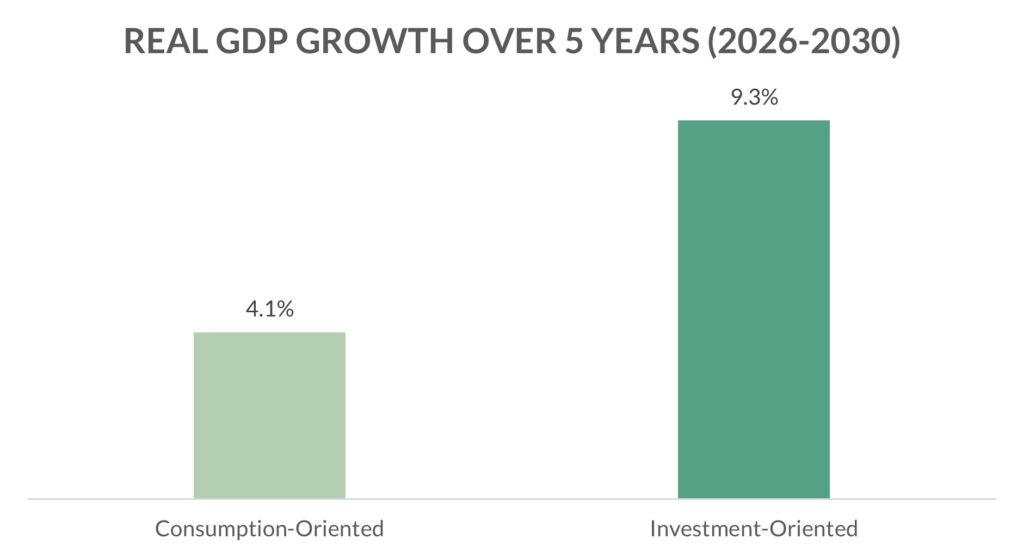

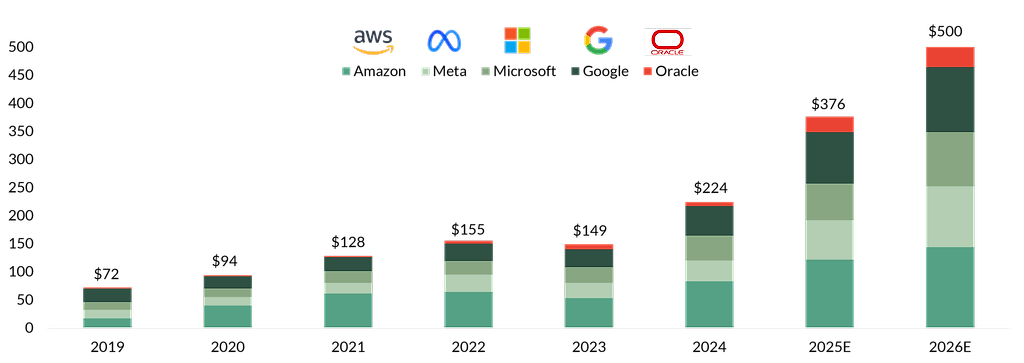

Germany, on the other hand, is primarily confronted with an acute growth crisis. The federal government should counter this stagnation with targeted investments and business-friendly measures in order to strengthen the country’s competitiveness and future economic growth. According to the German Council of Economic Experts, the use of the €500 billion special fund for infrastructure and climate protection, which is intended to modernize public infrastructure, support decarbonization, and stimulate the German economy, will determine whether Germany will only gain short-term growth momentum or whether it will be able to sustainably increase its potential growth1). This is because economists fear that the additional funds could be used for existing investment projects in order to have more money available in the core budgets for other projects, such as social welfare. This would result in additional debt without any sustainable fiscal stimulus. In its spring report, the German Council of Economic Experts compared the possible effects of a consumption-oriented versus an investment-oriented use of the infrastructure package.

Figure 1: Development of GDP growth and the government debt ratio

Source: German Council of Economic Experts, Spring Report 2025

Promoting short-term growth financed by debt through consumption expenditure is therefore not the answer to the growth crisis.

Artificial intelligence and falling interest rates are boosting the markets

Meanwhile, stock markets are defying the economic policy challenges facing industrialized countries and have risen by double digits since the beginning of the year.

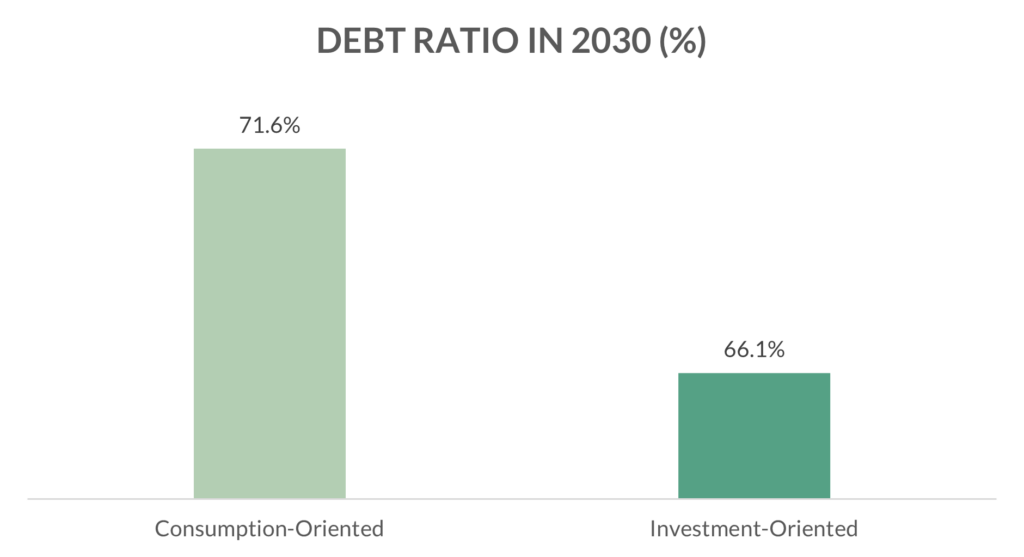

Alongside falling US key interest rates, the potential of artificial intelligence (AI) is currently the most important growth driver. The increasing expansion and use of artificial intelligence has led to a massive rise in computing requirements over recent years. While simple applications such as text recognition require only low computing power, the computing power required for image recognition and chatbots, for example, is increasing exponentially. This trend is continuing unabated – towards complex AI agents and the long-term goal of artificial general intelligence. This exponential increase in computing requirements, driven by growing model size and data volumes, requires huge investments in technical infrastructure. This year alone, the major technology companies are investing around $350 billion in ever-increasing computing power. Next year, this figure could even reach $500 billion. The “Magnificent 7”2) can draw on their cash flow for this purpose. However, increasing reports of debt-financed investments in AI have recently caught the attention of investors, as in the case of Meta. This is because the high investments in AI infrastructure, especially in data centers and specialized chips, are a clear indication of a major growth bet that could pay off for some technology giants – but not for others.

Figure 2: Capital expenditures of Microsoft, Alphabet (Google), Amazon, Meta, Oracle in billions of US dollars

Source: Bloomberg, as of November 14, 2025

A circular dependency is also emerging, contributing to high market concentration. One company’s capital expenditure (CapEx) is another’s revenue: Microsoft invests in OpenAI, OpenAI buys Nvidia chips, Microsoft and Google also buy chips from Nvidia for their own AI models. Circular AI deals and increasingly debt-financed AI investments are interpreted as warning signs of an AI bubble.

Stock markets are highly valued in some cases

The high valuation of the US technology sector is justified by the technological progress of AI, but also harbors enormous potential for setbacks. Due to the priced-in growth expectations, investors are increasingly sensitive to bad news that calls into question the growth potential of artificial intelligence or the prospect of falling key interest rates in the US. So far, however, stock markets have repeatedly recovered quickly in the current year – even after the tariff shock in April. This is because the potential of artificial intelligence is difficult to grasp, and while cautious voices warn of an AI bubble, visionaries continue to invest in the drivers of artificial intelligence.

A sober assessment of valuation levels is therefore correct and important, but the extent of the AI innovation surge in the coming years could put today’s valuations into perspective in retrospect. We believe that AI will continue to be one of the key drivers of the stock markets in 2026. Selection is important here, as there are likely to be more than just AI winners among the technology giants. For this reason, it is important to remain invested with an appropriate appetite for risk and not to lose sight of the fundamentals.

1) The potential growth of an economy is defined as the long-term development of gross domestic product with optimal utilization of existing capacity.

2) The Magnificent 7 include Apple, Nvidia, Alphabet, Meta, Amazon, Tesla, and Microsoft.

Disclaimer

This document has been prepared by ODDO BHF for information purposes only. It does not create any obligations on the part of ODDO BHF. The opinions expressed in this document correspond to the market expectations of ODDO BHF at the time of publication. They may change according to market conditions and ODDO BHF cannot be held contractually responsible for them. Any references to single stocks have been included for illustrative purposes only. Before investing in any asset class, it is strongly recommended that potential investors make detailed enquiries about the risks to which these asset classes are exposed, in particular the risk of capital loss.

ODDO BHF

12, boulevard de la Madeleine – 75440 Paris Cedex 09 France – Phone: 33(0)1 44 51 85 00 – Fax: 33(0)1 44 51 85 10 –www.oddo-bhf.com ODDO BHF SCA, a limited partnership limited by shares with a capital of €73,193,472- – RCS 652 027 384 Paris – Approved as a credit institution by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and registered with ORIAS as an insurance broker under number 08046444. – www.oddo-bhf.com